Medium-Sized Firm

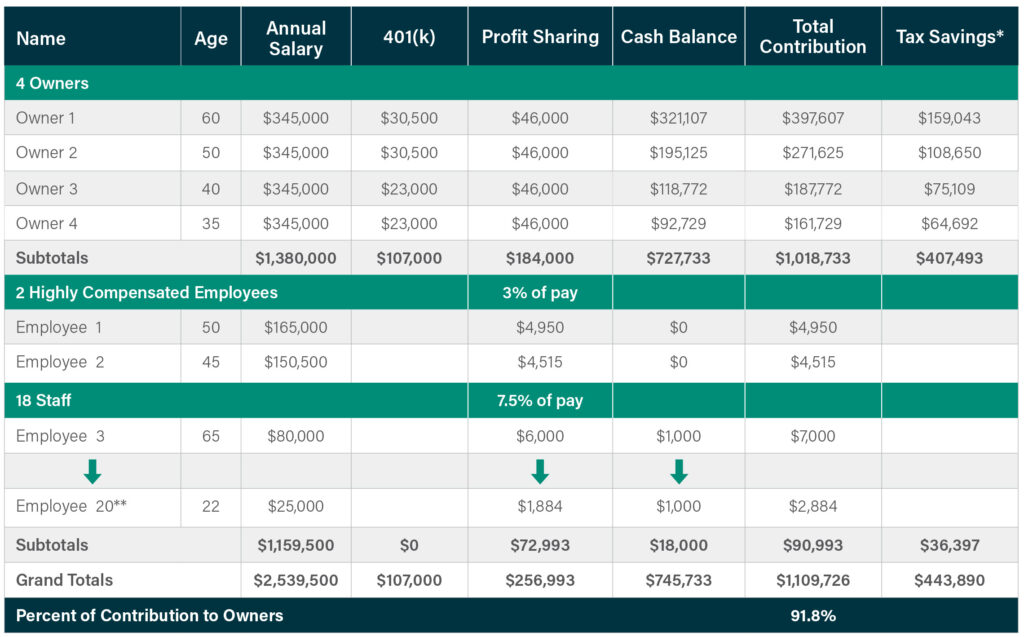

After 15 years of growing a small business from a garage to a sophisticated operation exporting internationally, four partners set their sights on getting prepared for retirement. All had invested heavily in growing the firm and felt significantly behind in their retirement savings goals.

FuturePlan added a Cash Balance plan to the 401(k) Profit-sharing plan currently in place. This action allowed the partners significantly higher contribution limits and the opportunity to acquire 20 years of savings into 10.

With these new limits, the partners could contribute 75% to 150% more to their savings plans. (e.g. $271,625/year for a 50-year-old). Now, all four partners have the reassurance of knowing they can retire very comfortably by age 65 or sooner.

Do you have clients or prospects looking to accelerate retirement savings and reduce their tax burden? To receive a Cash Balance Overview with one of our dedicated FuturePlan Cash Balance experts, fill out this quick form here.

Retirement Plan Illustration – 2024

*Important: If you want to obtain your own, or your client’s personalized scenario, please provide FuturePlan with a full, up-to-date owner and employee census in order to receive a customized plan design illustration. FuturePlan by Ascensus does not provide tax, legal, or accounting advice. This material has been prepared for informational and illustrative purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You or your client should consult your/their own tax, legal, and accounting advisors before engaging in any transaction. FuturePlan by Ascensus provides plan design, administration, and compliance services. It is not a broker-dealer or an investment advisor and does not provide tax, legal, or accounting services.

(Plan Limits) $23,000 for 401(k) plan; $7,500 catch-up; $46,000 profit sharing. This chart assumes a 45% tax bracket of combined federal and state taxes and taxes are deferred. The following assumptions also apply:

- Maximum annual contribution amounts for the cash balance/defined benefit plan are calculated using 4% interest rates and assuming no pre-retirement mortality and using the latest available applicable mortality tables.

- The maximum cash balance amounts assume a 3-year average compensation of at least $275,000 (the maximum annuity limit for 2024), and prior years of service.

- The amounts needed to fund the cash balance/defined benefit plan may be reduced by a participant’s prior highest 3-year salary history if it is less than the IRS maximum annuity limit (as shown above) or below the IRS maximum compensation limits under 401(a)(27) (e.g., $345,000 for 2024, $330,000 for 2023, etc.) and other deduction limits may apply.

- The amounts needed to fund in the cash balance/defined benefit plan will also be reduced if a participant participated in any prior cash balance/defined benefit plan of the employer or a related employer.

- Further, amounts shown may be reduced if the cash balance/defined benefit plan is not covered by the Pension Benefit Guaranty Corporation (PBGC), which may limit the amount available to fund in any paired 401(k) profit sharing plan of the employer. (Plans typically not covered by the PBGC are professional service businesses with less than 26 active participants.)

- It is also important to note that amounts shown are estimates and will vary depending on an employer’s demographics of owners and employees along with a myriad of other factors and considerations.

For details for a specific plan design, please call (877) CB-Plans or request a free Cash Balance illustration here. For further information about PBGC coverage see this link.

FuturePlan by Ascensus provides plan design, administration, and compliance services. It is not a broker-dealer or an investment advisor and does not provide tax, legal, or accounting services.

Two of the 18 staff members will need an increased profit sharing contribution to pass testing requirements.